Navigating Trust and Estates Law: Key Insights for Effective Planning

Authored by Izzat H. Riaz – Californian Paralegal, U.K. Certified Lawyer (LL.M.)

Estate planning is not just about documents. It is about control, clarity, and protecting the people and assets you have spent a lifetime building. In my experience working with trust and estates law as an LL.M. and certified paralegal, the biggest problems I see arise not from lack of wealth, but from lack of planning or outdated planning that no longer reflects reality.

Trust and estates law governs how assets are managed during life and distributed after death. It is shaped heavily by state law, and when no plan exists, state statutes decide who receives what, often in ways that surprise families and create unnecessary conflict. Thoughtful estate planning is how you keep those decisions in your hands.

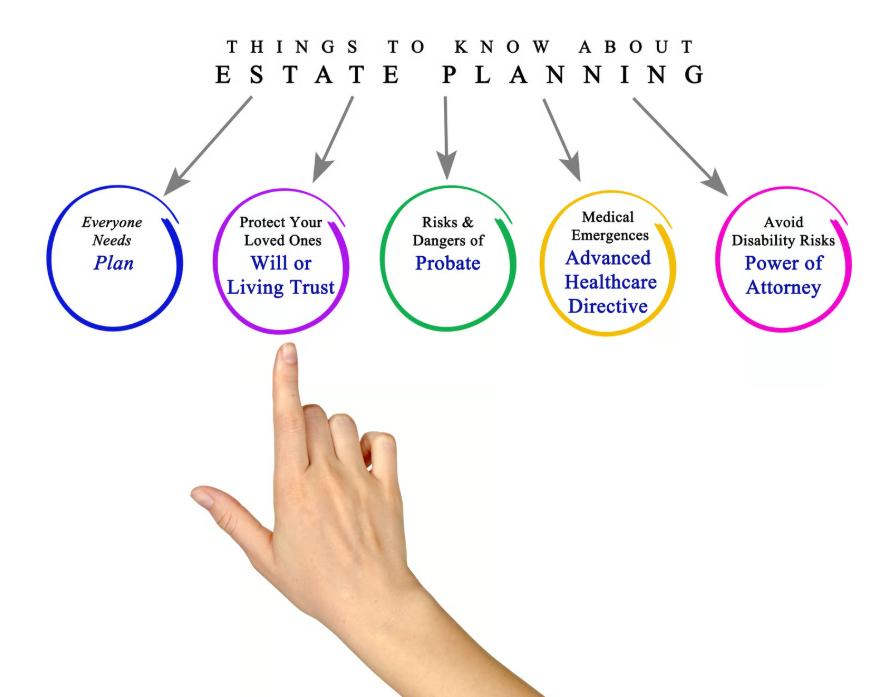

Creating a Strong Estate Plan

An effective estate plan typically includes a combination of wills, trusts, and beneficiary designations. Each serves a different purpose, and none should be treated as interchangeable.

Wills provide baseline instructions, but they often require probate, which can be time-consuming, public, and expensive. Trusts, particularly revocable living trusts, allow assets to pass outside of probate, offering privacy and efficiency for beneficiaries. Irrevocable trusts, including irrevocable life insurance trusts, can be powerful tools for tax planning and asset protection when structured correctly.

For high net worth individuals, estate planning is never one-size-fits-all. Advanced strategies are often necessary to address estate tax exposure, business interests, charitable goals, and multigenerational wealth transfer. This is where careful coordination with experienced estate counsel becomes essential.

Digital Assets and Modern Estate Planning

One of the fastest-growing problem areas in estate administration involves digital assets. Cryptocurrency, online financial accounts, cloud storage, social media profiles, and digital intellectual property now represent real economic and personal value.

Without clear instructions, fiduciaries can struggle to locate, access, or manage these assets. Worse, disputes can arise between beneficiaries over control or access. Trustees and executors have fiduciary duties that extend to digital assets, and failure to plan for them increases the risk of litigation.

Revocable trusts can provide flexibility during life, while irrevocable trusts may offer additional protection and tax advantages. Regardless of structure, digital assets must be identified explicitly, access instructions must be documented, and authority must be clearly assigned to avoid conflict and compliance issues.

Estate Administration and Fiduciary Duties

Estate administration is the process of managing and distributing assets after death. Depending on the structure of the estate, this may involve probate court oversight, trust administration, or both.

Trustees and executors carry significant fiduciary responsibilities. They are legally obligated to act in the best interests of beneficiaries, manage assets prudently, maintain transparency, and comply with state law. Even well-intentioned fiduciaries can face disputes if communication is poor or decisions are unclear.

Tax compliance is a major component of estate administration. The Internal Revenue Service plays a central role, and estates with significant assets face higher audit risk. Proper planning and accurate reporting reduce exposure and protect fiduciaries from personal liability.

Estate Litigation and Fiduciary Disputes

Despite best intentions, disputes happen. Estate litigation often arises from will contests, trust interpretation issues, allegations of undue influence, or claims that a fiduciary breached their duties.

Fiduciary litigation is particularly common where large or complex assets are involved, including digital property, closely held businesses, or private foundations. Courts may become involved when beneficiaries disagree over distributions or management decisions.

Alternative dispute resolution, such as mediation, can often resolve these conflicts more efficiently than litigation, preserving both assets and family relationships. Still, when litigation is unavoidable, experience in trust and estate disputes is critical.

Asset Management and Protection Strategies

Estate planning is inseparable from asset management and protection. Tools such as grantor retained annuity trusts, family limited partnerships, and carefully structured trusts can reduce tax exposure while safeguarding assets from creditors and unnecessary risk.

Private wealth planning requires coordination across tax law, estate law, and long-term financial planning. The goal is not just preservation, but orderly transition, especially when assets span generations.

Family Businesses and Succession Planning

Family-owned businesses introduce both legal and emotional complexity. Without clear succession planning, disputes over control, valuation, and management can tear businesses and families apart.

Estate planning strategies tailored to family enterprises can define ownership transitions, establish management authority, and reduce conflict. Nonjudicial settlement agreements and clear governance structures are often critical in maintaining continuity.

Tax Considerations That Cannot Be Ignored

Tax law shapes nearly every estate planning decision. Federal estate and gift tax rules, charitable deductions, and income tax consequences all affect how wealth is transferred.

Strategic gifting, charitable planning, and trust structures can significantly reduce tax burdens, but only when implemented proactively. Reactive planning almost always costs more.

Choosing the Right Trust and Estate Structures

Revocable trusts offer flexibility and control. Irrevocable trusts offer protection and tax benefits. Each has a place, but each also has tradeoffs.

Understanding these distinctions is essential to building an estate plan that aligns with your goals rather than undermines them. Poorly chosen structures can create rigidity, tax exposure, or unintended consequences.

Beneficiary Designations Matter More Than You Think

Beneficiary designations often override wills and trusts. Retirement accounts, life insurance policies, and payable-on-death accounts must be reviewed regularly to ensure consistency with the broader estate plan.

Outdated beneficiary designations are one of the most common causes of unintended distributions and post-death disputes. Coordination is key.

Managing Risk Through Insurance and Planning

Insurance plays a quiet but powerful role in estate planning. Life insurance can provide liquidity, equalize inheritances, and fund tax obligations. Liability insurance protects assets during life.

Risk management is about anticipating exposure and addressing it before it becomes a problem.

Final Thoughts

Trust and estates law is not static. Family structures change, laws evolve, assets shift, and digital property continues to grow in importance. An estate plan that worked ten years ago may be dangerously outdated today.

In my experience, effective estate planning is built on clarity, precision, and ongoing review. Working with knowledgeable trust and estate counsel allows individuals and families to protect their assets, minimize conflict, and ensure that their wishes are honored.

The best time to plan is before there is a crisis. The second-best time is now.